Carabela Newsletter #8

Wom filed for bankruptcy in the US. Aticco raised EUR 10m venture round. Koin raised a USD 7.3m debt facility.

Welcome to this week’s 3 new subscribers! My name is Ghers Fisman, and I send the Carabela Newsletter every Monday to keep you updated with the most important stories in Venture Capital, Startups and Innovation in Ibero-American markets. If you’d like to get in touch, please send me a message to ghersf91@gmail.com or my LinkedIn profile. I’ll be happy to have a chat!

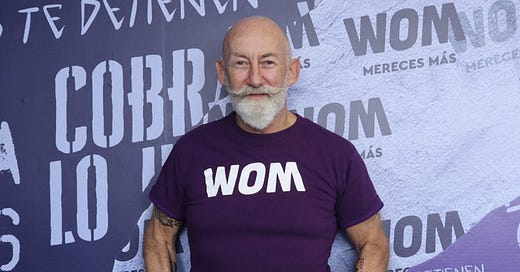

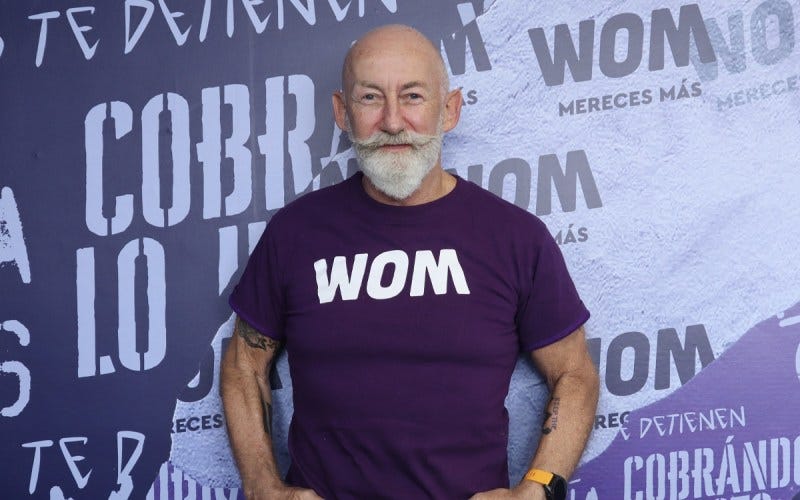

Good morning, I hope you had a great start to the 4th month of the year! Last week (April 1st to 7th), the biggest story in the region’s ecosystem was the filing for bankruptcy of Chile’s 4th largest Telecommunications operator, Wom after failing to refinance its debts.

📷 Credits: Wom

The week’s largest raises came from Spain (Aticco’s EUR 10m venture round), Brazil (Koin’s debt facility of USD 7.3m) and Mexico (Pulpos’ USD 4m Seed round). Three other multi-million dollar rounds were raised, all from Brazil: Lexter.ai’s USD 3.15m Series A, Inner AI’s USD 2m Pre-Seed and IZI’s USD 2m round. Smaller rounds were also raised by startups in Chile, Brazil and Spain.

In the M&A space, only one transaction was recorded, the acquisition of Uruguay’s Olacar by Chile’s Lolocar, for an undisclosed amount.

For more detail of these news (and more), continue reading:

Andes 🇧🇴 🇨🇴 🇪🇨 🇵🇪 🇻🇪

Bogotá-based fintech soonicorn Addi launched Addi Marketplace, allowing its customers to do purchases directly in the app, using their BNPL solutions. (Latam Fintech Hub)

Cono Sur 🇦🇷 🇨🇱 🇵🇾 🇺🇾

Santiago-based telecommunications startup Wom filed for bankruptcy in the United States, unable to refinance a USD 348m debt payment due in November. (Bloomberg Línea)

Santiago-based fintech Radar raised a Seed round of USD 1.5m led by The Fintech Fund and Everywhere Ventures to finance its expansion to Mexico. The company also plans to raise a Series A in 18 months. (Contxto)

Santiago-based car-sharing startup Lolocar acquired its Montevideo-based competitor Olacar for an undisclosed amount, to expand to Uruguay, while also eyeing other markets in the region, such as Colombia, Peru and Brazil. (Startups Latam)

Brasil 🇧🇷

São Paulo-based BNPL startup Koin raised USD 7.3m in Venture Debt, in an operation structured by Itaú. The funds will be used to expand its solutions to the tourism sector. (LatamList)

São Paulo-based legaltech Lexter.ai raised a USD 3.15m Series A led by Alexia Ventures to expand its operations in Brazil. (Contxto)

Brazil’s Inner AI raised a USD 2m Pre-Seed round led by Canary, to continue investing in R&D and launch its platform in the Brazilian market. (LatamList)

Fortaleza-based retail startup IZI raised USD 2m from Domo.vc to expand its Brazilian operations and make key hires for their commercial and product teams. (Startupi)

São Paulo-based fintech CashU raised USD 1.4m in an operation led by Bertha Capital, to finance its regional expansion. (Latam Fintech Hub)

Brasilia-based foodtech Mercado Único raised a USD 395k Pre-Seed round led by Techstars. (LatamList)

São Paulo-based edtech Ada raised a Pre-Series A round from Wayra for an undisclosed amount, with the goal of growing the company’s sales and product teams. (LatamList)

Iberia 🇵🇹 🇪🇸

Barcelona-based coworking startup Aticco raised a EUR 10m funding round from several family offices to finance its expansion in the Iberian Peninsula. (Capital Riesgo)

Barcelona-based skincare startup Holaglow raised a EUR 1.2m a Seed round led by Demium Capital, with three goals: brand strengthening, opening of new clinics and growing the team. (Forbes España)

Pamplona-based healthtech MediBiofarma raised a EUR 1m funding round led by SODENA and Inveready, to get regulatory approval of three products already in Clinical Stage. (Web Capital Riesgo)

México, Centroamérica y Caribe 🇨🇷 🇨🇺 🇩🇴 🇸🇻 🇬🇹 🇭🇳 🇲🇽 🇳🇮 🇵🇦 🇵🇷

Mexico’s Pulpos, a startup helping SMEs on their digitalization journeys, raised a USD 4m Seed round. The funds will be used to grow their software development team and enhance the company’s capabilities with AI. (LatamList)

That’s it for today. I hope you enjoyed this edition of the newsletter. Have a great week, and see you next Monday!

If you have any feedback, comments or just want to have a chat, please contact me at ghersf91@gmail.com or my LinkedIn profile, I’ll be glad to hear from you!